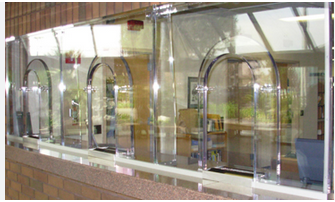

With regards to consumer banking, the teller windowpane is a vital section of the process. Buyers depend on tellers to take care of their dealings, and banking companies count on efficient tellers to keep their teller windows operations running smoothly. But the thing that makes the teller home window this kind of important part of a bank’s good results? In the following paragraphs, we’ll check out the necessity of efficiency with the teller window and just how banks can enhance their teller method.

Streamlining the Deal Procedure: With regards to managing transactions, pace and accuracy are essential. Consumers have to get in and out of your lender quickly making use of their transactions finished appropriately. Banking institutions that improve their teller windowpane functions offers faster service to their clientele, lowering wait around occasions, and enhancing overall customer satisfaction. By streamlining the deal procedure, tellers can serve much more customers and move facial lines faster.

Digital Transformation: As technological innovation is constantly move forward, financial institutions are researching ways to digitize their functions minimizing the reliance on paper-structured deals. Implementing electronic digital alternatives like income recyclers, electrical signatures, and programmed teller equipment will help decrease funds handling and increase total performance. These solutions could also free up tellers’ time and permit them to focus on more complex consumer demands, like financial assistance and assessment.

Education and Assist: To maximize effectiveness in the teller window, it’s important to have well-trained tellers. Teller training should cover anything from deal dealing with to customer support abilities. Banks should also supply tellers with on-going help, such as mentoring and gratification feedback, to assist them to boost their skills and remain engaged. A well-skilled and determined teller crew can handle great volumes of purchases efficiently.

Customer Support: The teller windowpane is usually the initial reason for make contact with from a bank and its buyers. As such, it’s important to supply superb customer satisfaction all the time. Including from greeting clients using a look to coping with purchases successfully and correctly. Banks that prioritize customer care with the teller window will develop stronger interactions because of their clients, increasing maintenance and customer loyalty.

Details and Google analytics: Banking companies get access to huge amounts of information, and utilizing that data will help maximize the teller windowpane process. By checking deal quantities, wait times, and teller efficiency, banks can recognize bottlenecks and regions for enhancement. Using this type of information and facts, banking companies can adjust staffing ranges, training applications, and technologies solutions to maximize productivity with the teller home window.

Simply speaking:

The teller window might appear to be a little part of the business banking procedure, however it plays an important role in the overall accomplishment of a lender. By improving the teller windows procedure through streamlining purchases, digital transformation, staff instruction, customer service concentrate, and information statistics can lead to increased customer happiness, elevated financial transaction quantity, and eventually, a thriving banking organization. Banks that prioritize efficiency in the teller windows will likely be far better situated to conditions any hard storms which could can come their way later on.